The Tax Service Massively Checks Online Business: What Entrepreneurs Can Be Fined For.

The Tax Service Checks Online Business

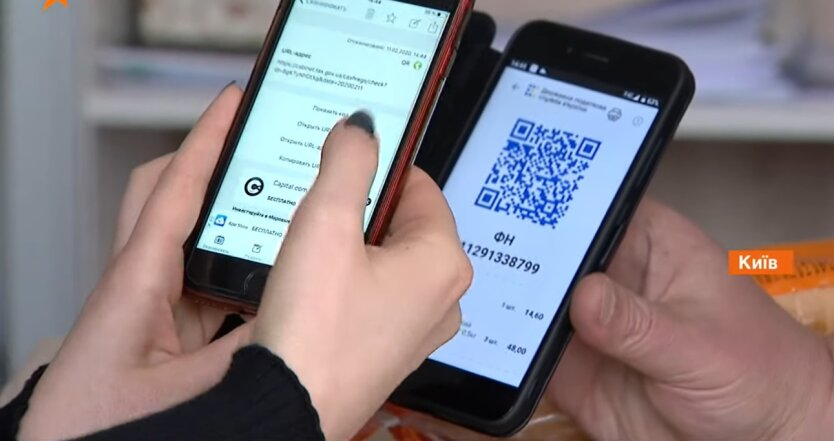

Since the beginning of November 2024, the Tax Service has conducted about 50 audit inspections and discovered numerous violations in the use of cash register systems (CRS). Special attention is paid to monitoring internet platforms and sites where goods are sold. During the inspections, facts were established regarding the sale of expensive equipment and electronics without the use of CRS and without accounting for inventory.

Since the beginning of November 2024, the Tax Service has conducted about 50 audit inspections that revealed numerous violations in the use of CRS. During the inspections, facts were established concerning the sale of expensive equipment and electronics without the proper use of CRS and accounting for inventory.

Penalty Sanctions for Violating Cash Discipline

As of October 1, 2023, penalty sanctions for violating cash discipline have been reinstated. For the first violation, a fine of 100% of the value of sold goods or services is provided, for a repeat violation - 150%. For single taxpayer entrepreneurs who are not VAT payers, preferential conditions apply until July 31, 2025. Their fines are 25% of the value of goods for the first violation and 50% for the repeat violation. The sale of excise goods, technically complex household goods, medical products, and jewelry does not fall under these privileges.

As of October 1, 2023, penalty sanctions for violating cash discipline have been reinstated. For the first violation, a fine of 100% of the value of sold goods or services is provided, for a repeat violation - 150%. For single taxpayer entrepreneurs who are not VAT payers, preferential conditions apply until July 31, 2025.

Results of Inspections

Penalties totaling 1.4 million hryvnias have already been imposed.

Read also

- Fled from G7 and scandalized over Putin: what the new summit was remembered for by Trump

- To clear land in Ukraine, almost 1 trillion UAH is needed - MP

- Furniture, pharmaceuticals, products: processing enterprises will receive grants

- The meteorologist explained when the real summer heat will hit Ukraine

- The borscht index has been updated again: Ukrainians revealed the real cost of the main dish

- Not TCC: The Armed Forces responded who can determine suitability for service